Costs outside of the purchase price may include shipping, taxes, installation, and modifications to the asset. We also address some of the terminology used in depreciation determination that you want to familiarize yourself with. Finally, in terms of allocating the costs, there are alternatives that are available to the company. We consider three of the most popular options, the straight-line method, the units-of-production method, and the double-declining-balance method. The depreciation is an expense allowed to deduct from the company’s profit.

Sum-of-the-Years’ Digits Method

The revised calculations would then be reflected in the subsequent journal entries for depreciation. This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price or until that asset is disposed of. As with the straight-line example, the asset could be used for more than five years, with depreciation recalculated at the end of year five using the double-declining balance method. Probably one of the most significant differences between IFRS and US GAAP affects long-lived assets. This is the ability, under IFRS, to adjust the value of those assets to their fair value as of the balance sheet date. The adjustment to fair value is to be done by “class” of asset, such as real estate, for example.

Adjusting entry for depreciation expense

This technique is used when the companies utilize the asset in its initial years as the asset is more likely to provide better utility in these years. Being the simplest method, it allocates an even rate of depreciation every year on the useful life of the asset. It estimates the asset’s useful life (in years) and its salvage value at the end of its term.

Units of Production Method

The SYD method of depreciation is useful because it may provide a more accurate representation of the true decrease in the value of the asset over time. However, it can be more complicated to calculate than the straight-line method and may not be appropriate for all types of assets. In accounting, depreciation is recognized as an expense that reduces the value of the asset on the balance sheet over its useful life.

- The useful life of technology is typically shorter than that of buildings or machinery.

- Each method has its own advantages and disadvantages, and companies can choose the method that best suits their needs.

- With the help of this method, organizations can easily assess the consumption of the asset over the years.

- Recording depreciation accurately is essential for business accounting, as it accurately represents the value of their assets over time.

- This may include wiring, switches, sockets, light fittings, fans, and other electrical fittings.

- An advantage of using a depreciation worksheet is that it can serve as the basis for the depreciation journal entry.

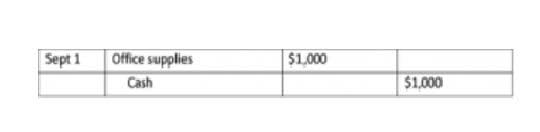

Step 3: Record the Journal Entry

The account Accumulated Depreciation is a balance sheet account and therefore its balance is not closed at the end of the year. In each accounting period, part of the cost of certain assets (equipment, building, vehicle, etc.) will be moved from the balance sheet to depreciation expense on the journal entry for depreciation income statement. The goal is to match the cost of the asset to the revenues in the accounting periods in which the asset is being used. The company can make depreciation expense journal entry by debiting the depreciation expense account and crediting the accumulated depreciation account.

- The company takes 50,000 as the depreciation expense every year for the next 5 years.

- Depreciation expense represents the portion of an asset’s value allocated as an expense in a particular accounting period.

- In accounting, depreciation is recognized as an expense that reduces the value of the asset on the balance sheet over its useful life.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

The net book value of an asset is determined by taking the sum of the fixed asset account – which has a debit balance – and the accumulated depreciation account – which has a credit balance. Over time, the net book value of an asset will decrease until its salvage value is reached. Additionally, the book value may be difficult to determine accurately, which can affect the accuracy of the depreciation calculation. The declining balance method calculates depreciation based on a fixed percentage rate, which is applied to the asset’s book value each year. The book value is the cost of the asset minus the accumulated depreciation.

By continuing this process, the accumulated depreciation at the end of year 5 is $49,000. Therefore, the net book value at the end of year 5 is $1,000 which is the estimated scrap value. From the example, the total cost of the machinery is $50,000, the scrap value is $1,000 and the useful life is 5 years.

The IRS has established specific rules for determining the class life of assets. For example, the class life of office furniture and equipment is seven years. The class life of residential https://www.bookstime.com/ rental property is 27.5 years, and the class life of nonresidential real property is 39 years. For example, ABC Company acquired a delivery van for $40,000 at the beginning of 2018.

Method 1 – Depreciation Charged to the Asset Account

The accumulated depreciation is deducted from the cost of the assets to find the net book value of the fixed assets. When a business purchases a fixed asset, it is expected to use the asset for a certain period of time. The cost of the asset is then allocated over its useful life through depreciation.